oregon tax payment due date

Income tax deadline has been moved from April 15 to May 17. To review for the 2020 tax year if you.

State Of Oregon Members Member Annual Statements Tier One Tier Two Faq

Pay the one third amount by November 15 no discount is allowed.

. Individual taxpayers can also postpone state income tax payments for the 2020 tax year due on April 15 to May 17 without penalties and interest regardless of the amount. The Department of Revenue is joining the IRS and automatically postponing the income tax filing due date for individuals for the 2020 tax year from April 15 2021 to May 17 2021. Estimated tax payments are still due April 15 2021.

Estimated payments have the same due dates as for calendar-year personal income tax filers. The Oregon tax payment deadline for payments due with the 2019 tax year return is automatically extended to July 15 2020. If you have any questions the tax office is open during regular business hours.

April 15 June 15 September 15 and January 15 after the tax year ends. Oregon Department of Revenue. Taxpayers must make their second payment for Oregons new Corporate Activity Tax CAT by July 31 2020.

In step with a similar move from the federal government those filings are now due July 15 months after the usual April 15 deadline. Quarter Period Covered Due Date. The first payment is due by November 15th.

Oregon has not postponed the due date for first-quarter estimated income tax payments for 2021. The personal income tax returns filing and payment due date is extended from April 15 2020 to July 15 2020 including. If you choose this installment schedule the final one-third payment is due on or before May 15.

The Revenue Division is automatically extending the Portland and Multnomah County business tax payment due with the 2020 tax year return. Regardless of which option is chosen payment due dates are April 15 2021 for Voucher 1 July 31 2021 for. April 15 July 31 October 31 January 31.

To electronically pay state payroll taxes including the WBF assessment by electronic funds transfer EFT use. Marion County mails approximately 124000 property tax statements each year. The Oregon return filing due date for tax year 2019 is automatically extended from April 15 2020 to July 15 2020.

Due Dates for 2021 - 2022 Tax Payments. November 15th Monday 2021 February 15th. Estimated tax payments for tax year 2020 are not.

Individual taxpayers including those who pay self-employment tax can. Form OR-40 OR-40-N and OR-40-P Oregon. The due dates for estimated payments are.

2022 third quarter individual estimated tax payments. The February 1st deadline to make the 4th quarter payment for the Oregon Corporate Activity Tax CAT is coming up on us quickly. Is the department going to charge UND interest.

After much debate and pressure from a number of accounting professional groups the Internal Revenue Service recently announced that it is pushing back the individual. THANKS TO OUR SPONSOR. 2021 individual income tax returns filed on extension.

Cash payments must be made at our Salem. Oregon Corporate Activity Tax payment deadline July 31 2020. 2022 second quarter individual estimated tax payments.

Mail check or money order with voucher to. The Oregon tax payment deadline for payments due with the. Tax Year 2020 Payment Deadline.

The statements are mailed between. Quarterly Use Fuel Seller and User Tax Reports must be received by the department on or before the due dates according to the following schedule. Photo Metro Creative Connections.

Form OR-CAT-V Oregon Corporate Activity Tax Payment Voucher. Oregons April 15 2021 estimated tax payment due date for tax year 2021 has not been postponed and is still due on April 15 2021. For tax year 2022.

Annual domestic employers payments are due on January 31st of each year. Important Dates Installment Options Postmarks.

Oregon Revenue Dept Orrevenue Twitter

Blog Oregon Restaurant Lodging Association

Key 2021 Dates For The Oregon Corporate Activity Tax Jones Roth Cpas Business Advisors

Tax Statement Explained Lincoln County Oregon

Key 2021 Dates For The Oregon Corporate Activity Tax Jones Roth Cpas Business Advisors

Understanding Your Property Tax Bill Clackamas County

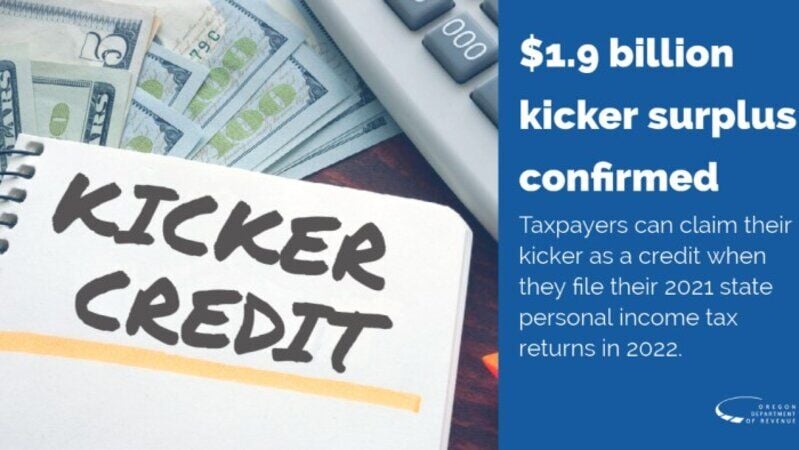

Oregon Taxpayers Will Receive Kicker Rebate On 2021 Tax Returns Thanks To 1 9 Billion Surplus Local Kdrv Com

Key 2021 Dates For The Oregon Corporate Activity Tax Jones Roth Cpas Business Advisors

Where S My Refund Oregon H R Block

State Of Oregon Oregon Department Of Revenue Payments

Oregon Revenue Dept Orrevenue Twitter

Portland 90 Day Notice Of Rent Increase Ez Landlord Forms Being A Landlord Rental Agreement Templates Rental Property Management

Yes California Has The Highest Tax Revenue California Has Some Of He Highest Taxes But It Also Has The Family Money Saving Business Tax Economy Infographic

Key 2021 Dates For The Oregon Corporate Activity Tax Jones Roth Cpas Business Advisors

Oregon Taxpayers Will Receive Kicker Rebate On 2021 Tax Returns Thanks To 1 9 Billion Surplus Local Kdrv Com

Oregon State 2022 Taxes Forbes Advisor

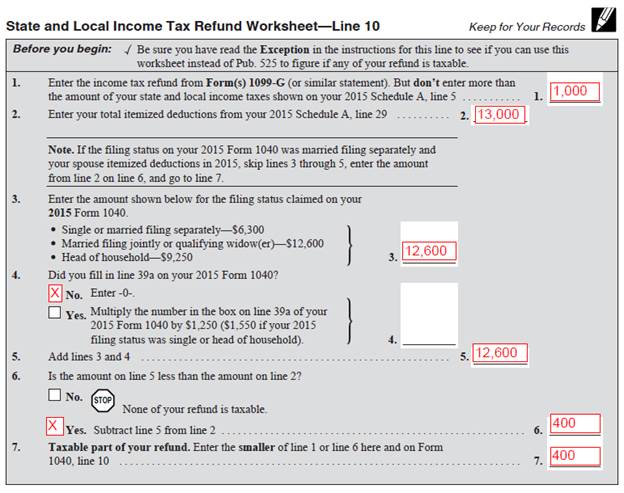

Odr 1099 G Question And Answers Oregon Association Of Tax Consultants