how much is tax on food in massachusetts

While Massachusetts sales tax generally applies to most transactions certain items have special treatment in many states when it comes to sales taxes. How much will the Massachusetts tax rebate be.

Massachusett S Menu Pollo Royal

Our calculator has recently been updated to include both the latest.

. You are able to use our Massachusetts State Tax Calculator to calculate your total tax costs in the tax year 202223. This page describes the taxability of. All restaurant food and on-premises consumption.

The state has billions of dollars in excess tax revenue to pay back. The base state sales tax rate in Massachusetts is 625. The tax is 625 of the sales price of the meal.

How much is tax on food in Massachusetts. Massachusetts officials announced last week that 3 billion in surplus tax revenue will be returned to taxpayers. The ballot question called Chapter 62F allows for tax.

The most significant taxes in Massachusetts are the sales and income taxes both of which consist of a flat rate paid by residents statewide. For tax year 2022 the Child Tax Credit reverts back to the benefits available prior to the American Rescue Plan as follows. The Massachusetts income tax rate.

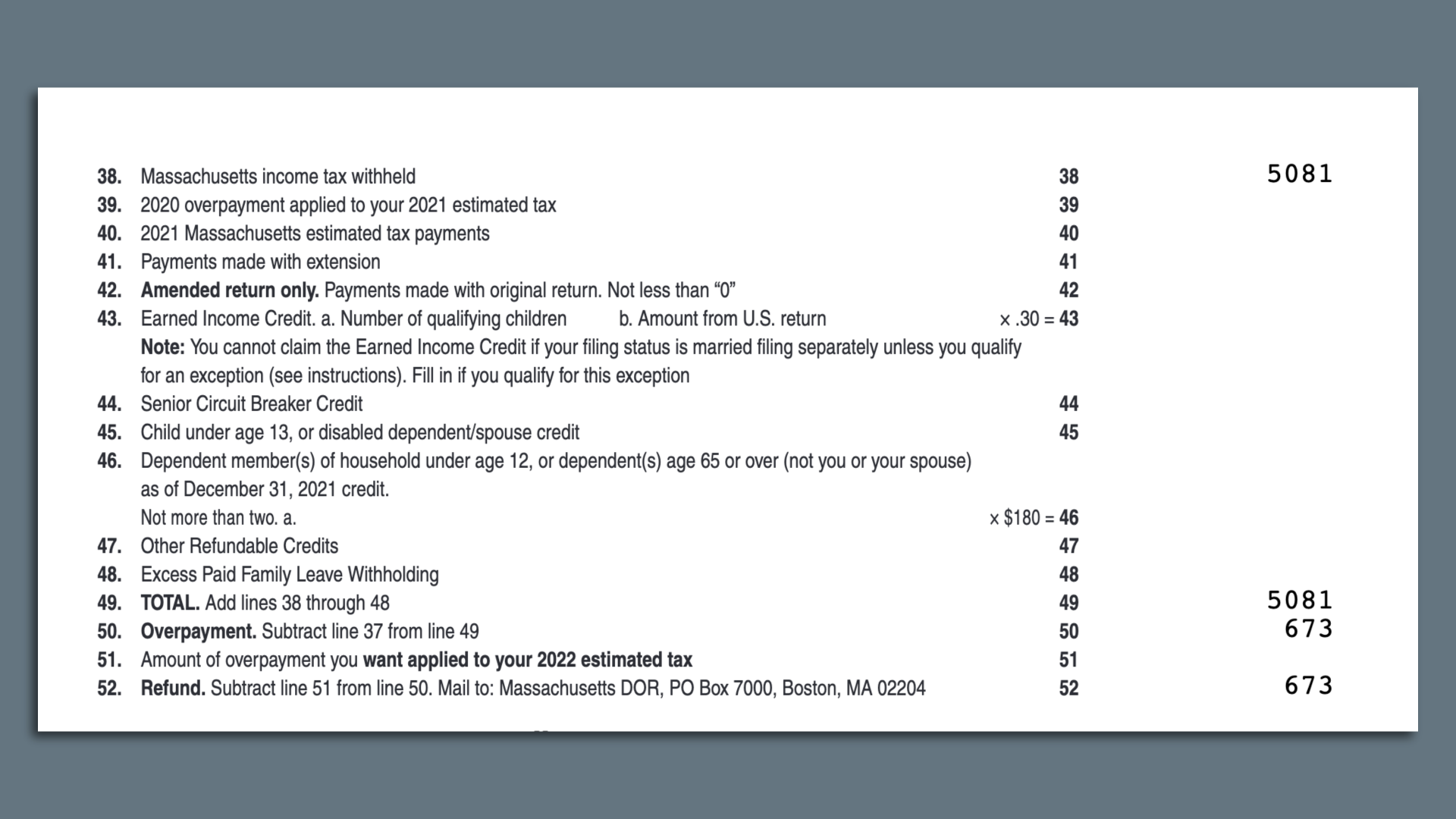

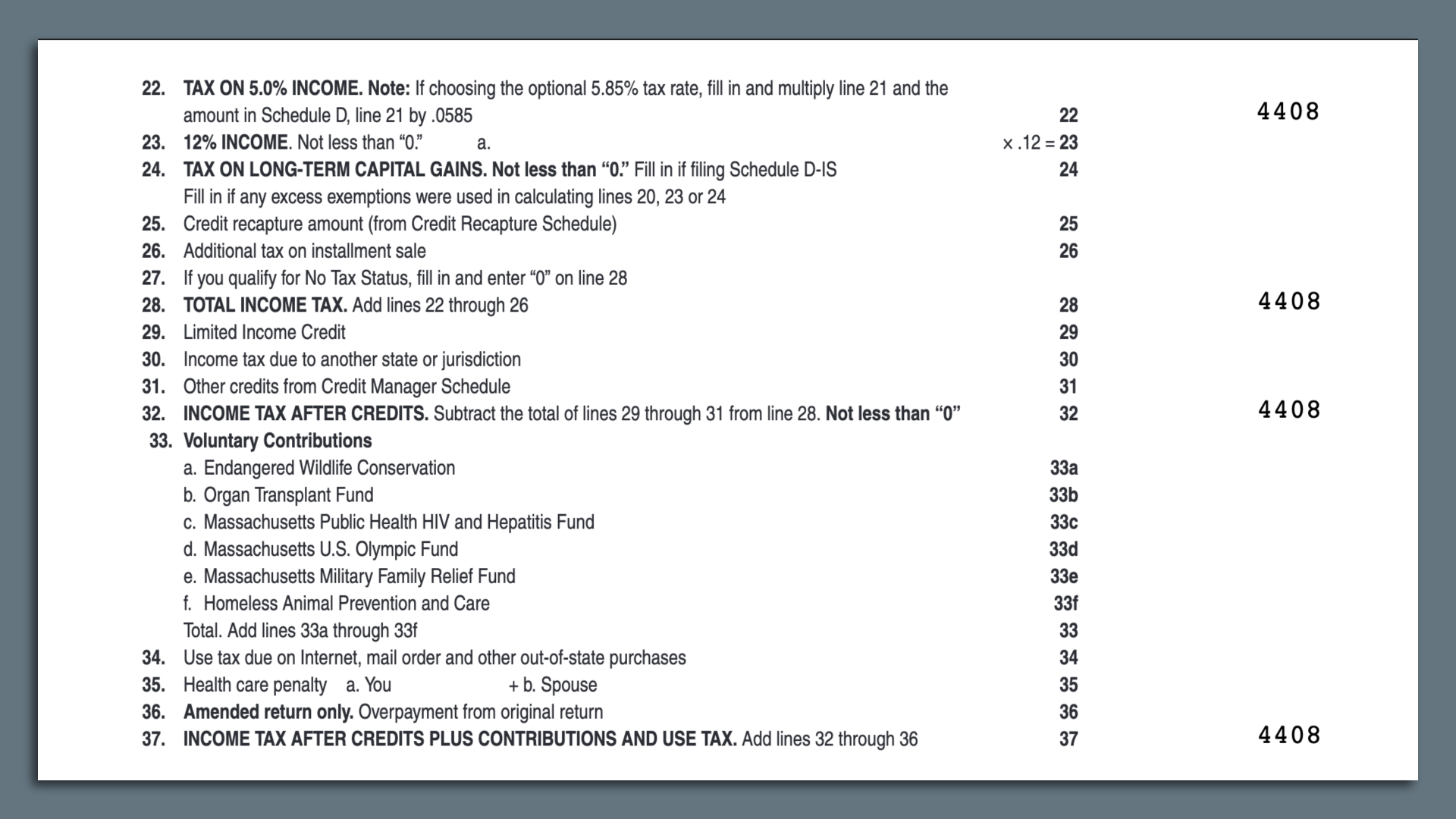

Massachusetts imposes a sales tax on meals sold by or bought from restaurants or any restaurant part of a store. Massachusetts is a flat tax state that charges a tax rate of 500. 17 2022 are eligible even if they didnt file an extension request.

Massachusetts is returning 2941 billion in excessive revenue to taxpayers thanks to an obscure law from 1986. That statewide tax is currently 625 which is also Massachusetts statewide sales tax rate. Massachusetts has a separate meals tax for prepared food.

That goes for both earned income wages salary commissions and unearned income interest and dividends. State Auditor Suzanne Bump announced Thursday that she had. Massachusetts imposes a sales tax on meals sold by or bought from restaurants or any restaurant part of a store.

Groceries and prescription drugs are exempt from the Massachusetts sales. The Massachusetts state sales tax rate is 625 and the average MA sales tax after local surtaxes is 625. The tax is 625 of the sales price of the meal.

Local tax rates in Massachusetts range from 625 making the sales tax range in Massachusetts 625. Sales tax on meals prepared food and all beverages. Generally food products people commonly think of as groceries are exempt from the sales tax except if they.

Monthly on or before the 20th day following the close of the tax period. The state income tax is charged at a flat rate of 5 and the sales tax is charged at a rate of 625. Charlie Baker originally proposed a 250 refund intended for individual filers who earned between 38000 and 100000 last year and.

Massachusetts taxpayers struggling with sky-high inflation should expect to get their chunk of a nearly 3. Reverts back to up to 2000 for 2022 2025. Massachusetts imposes a sales tax on meals sold by or bought from restaurants or any restaurant part of a store.

Massachusetts offers tax deductions and credits to reduce your tax liability including a. People who filed their Massachusetts state 2021 tax return on or before Oct.

![]()

Massachusetts Income Tax Drops To 5 Flat Rate 20 Years After Passage

Charlie Baker Proposes Two Month Sales Tax Holiday As Massachusetts Revenues Blow Past Estimates

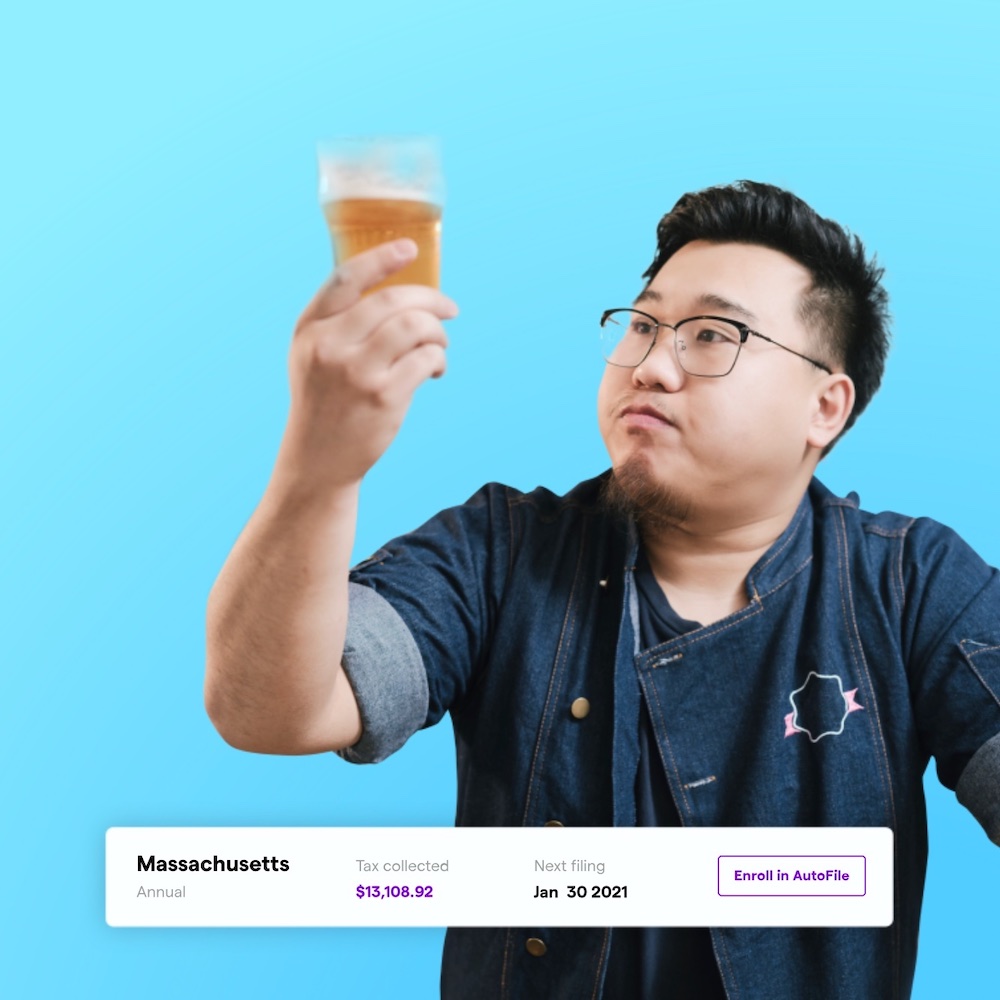

Massachusetts Sales Tax Rate Rates Calculator Avalara

Thai Noodle Bar Menu In Quincy Massachusetts Usa

Low Income Housing Tax Credit Impact In Massachusetts Mel King Institute

Everything You Need To Know About Restaurant Taxes

Kevin Mass Food Tax Isn T A Math Problem It S A Moral Problem

Cedar Street Grille Posts Sturbridge Massachusetts Menu Prices Restaurant Reviews Facebook Sturbridge Ma

Massachusetts Stmab 4 Fill Out And Sign Printable Pdf Template Signnow

Utah Lawmakers Are Discussing An Increased Tax On Food Here S What That Means Kutv

Massachusetts Gives Shoppers Another Sales Tax Free Weekend Wamc

The N H Mass Tax Fight Could Have Implications That Go Far Beyond Our Borders The Boston Globe

2021 Personal Income And Corporate Excise Tax Law Changes Mass Gov

Massachusetts Estate Tax Doesn T Have To Be So Confusing Ladimer Law Office Pc